Stories

Batemans Bay Post: First Nations money matters course gets students thinking about future

2 min read

Batemans Bay Post: First Nations money matters course gets students thinking about future

Admin 5 March 2024

While Batemans Bay High School student Jackson Gorham-Nolan knows how to set up a bank account he is still learning the finer details of how to manage his finances once finishing school.

"I only have basic knowledge. We're being taught about compound interest with superannuation and how we should start early in order to benefit," he said.

The year 12 student now has a stronger grasp of how to manage his money, thanks to a two-day workshop in Batemans Bay on Thursday, February 29, and Friday, March 1.

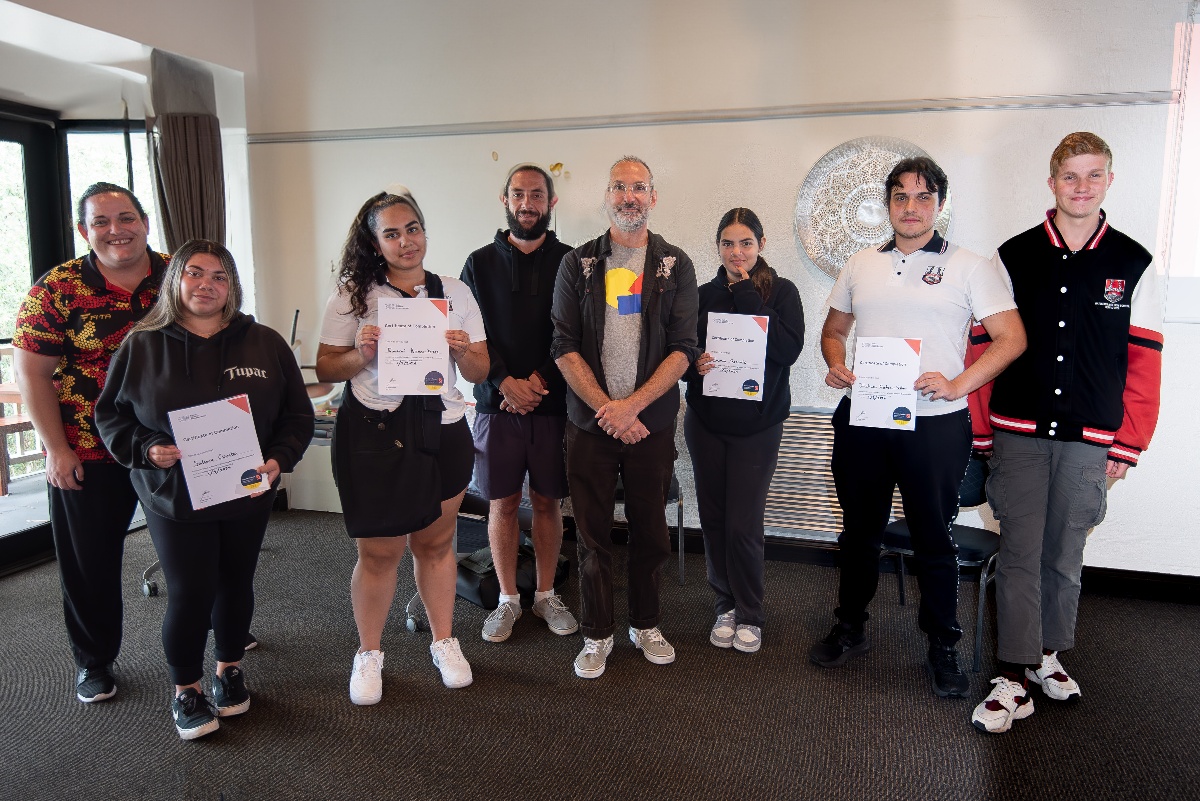

Mr Gorham-Nolan was amongst a group of First Nations students who completed a program called Invest in Yourself: Exploring Money & Self-Employment.

Backed by the NSW Government's Regional Aboriginal Partnerships Program, the workshop is delivered by the Sydney School of Entrepreneurship (SSE).

Students discuss their approach to money management as well as what training and employment options are available once leaving school. The workshops also outline the fundamentals of starting a business and how to generate an income through self-employment.

Run by SSE trainer Frank Newman and Mogo's Jordan Nye, a Walbunja man from the Yuin Nation, the program takes what can be a dry subject area and looks for creative ways to engage the students.

"I'm always surprised that this age group are way more financially literate than myself or my peers where when we were that age," Mr Newman said

"They've got two or three bank accounts and they're moving money between them. But when it gets to questions around things like superannuation or credit and things like buy now, pay later, they sort of know about it but their knowledge is limited."

Mr Newman said he discusses some of the opportunities and threats around lending while also hitting on the importance of managing your super from a young age.

Mr Gorham-Nolan said it was an chance for him to put some of these concepts into practice.

"I understand how to. It guess it's putting it into practice, I find it a little bit challenging but after Frank showed us the SMART technique it gives us the foundations of how to start budgeting," he said.

The second day of the workshop focuses on what is an entrepreneur and how the students might be able to establish their own business

Mr Newman said he was able to draw on the experience of Jordan Nye, who is co-founder and CEO of Muladha Gamara - an Indigenous owned business running cultural tourism experiences, youth programs and traditional dance.

"The beautiful thing that happens is the kids come up with these amazing ideas to solve these complex problems and their businesses often have a social enterprise edge to them and they're about giving back," Mr Newman said.

"If there is one objective of this workshop it's to open up that they can see this as a possibility for the future - you don't have to become an employee, you can become a master of your own destiny and set up your own business."

The workshops are also in Bathurst, Kempsey, Tumut, Cardiff, Armidale, Nowra and Dubbo.

So far the program has recorded:

- 87 percent of respondents indicating that they had achieved a very good to excellent understanding of basic finance and were able to set financial goals, up from 12 percent at the start of the program.

- 100 percent of respondents considered they had a good to excellent understanding of taxes, superannuation and credit, up from 10 percent at the start.

- 66 percent of respondents identified themselves as acquiring a very good to excellent knowledge of entrepreneurship and how to start a business, up from zero at the start.

Written by Ben Carr and originally published in

Author: Ben Carr Date: 5 March 2024 Publication: Batemans Bay Post

Disclaimer- This article was first published on Batemans Bay Post by Ben Carr on 5 March, 2024

Related Stories